Leverage stock calculator

The Margin Requirement is 001 or 1. If you sell a call option and the option seller exercises it you need to buy 100 shares of the stock to sell to the person who holds the call.

Profxtrades Risk Management Guide Follow Profxtrades For More Daily Tips And Analysis Trading Charts Forex Trading Training Stock Trading Strategies

Before deciding to trade you should carefully consider your investment objectives level of experience and risk appetite.

. Leverage and margin refer to the same concept just from a slightly different angle. Weighted Average Cost of Capital WACC Calculator. For example if the Leverage Ratio is 1001 heres how to calculate the Margin Requirement.

For instance GER30 is traded in Europe which means that the point value is given in EUR Euro. If the strike price is 50 and the market value for the stock is 60 youll lose 1000. Stock brokers can accept securities as margin from clients only by way of pledge in the depository system wef.

Margin Requirement 1 Leverage Ratio. Yes Nifty50 registered a Gold crossover of EMA on the daily charts in the August series but in September we have a crucial US Fed meeting where interest rates might further go up which is a threat in the near term for Global stock markets. Update your mobile number e-mail ID with your stock brokerdepository participant and receive OTP directly from depository on your email id andor mobile number to create pledge.

If the stock price rises and all other variables remain unchanged then the price of the option will go down. All quotes are in local exchange time. For example if the margin is 10 and you want to invest Rs.

So in a nutshell this free stock calculator will show you. 1 How much dollar value you should invest in based on your overall investment amount. Client account and position eligibility requirements exist and approval is not guaranteed.

Specify the leverage that you use for trading. Trading with leverage can work against you as well as for you. Leverage trading in crypto is a way of using borrowed funds to trade cryptocurrencies with more capital than initially invested in the trading account.

Leverage is nothing more or less than using borrowed money to invest. Leverage Trading Crypto Guide. Earnings Before Interest and Taxes EBIT Calculator.

Trading crypto with leverage increases the buying power for the investor where he or she is able to multiply profits from 2 times up to several hundred times depending on the leverage ratio used. Real-time last sale data for US. Stock Risk Premium Calculator.

Update your mobile number e-mail ID with your stock brokerdepository participant and receive OTP directly from depository on your email id andor mobile number to create pledge. So in order to calculate the margin required to trade in FO for the stocks or indexes you desire you need an FO. For example if a put has a delta of -070 and the stock goes up 1 in theory the price of the put will go down 070.

Businesses widely use leverage. In the September series investors should avoid any leveraged positions. If you are looking for a forex trading calculator trading calculator cryptocurrency forex profit calculator with leverage or forex power indicator we have tools that can help you with this.

US500 is traded in the US so the point value will be in US Dollars. If the market value of a share is 1000 youll lose 95000. Use of portfolio margin involves unique and significant risks including increased leverage which increases the amount of potential loss and shortened and stricter time frames for meeting deficiencies which increase the risk of involuntary liquidation.

Apple Inc Balance sheet Explanation. There you have it. Check ask and bid prices.

The calculator is built primarily for the stock market and helps you buy or sell any stock ETF or mutual fund and control your maximum risk per position. 001 1 100. A list of all traded symbols and their pip values is shown below.

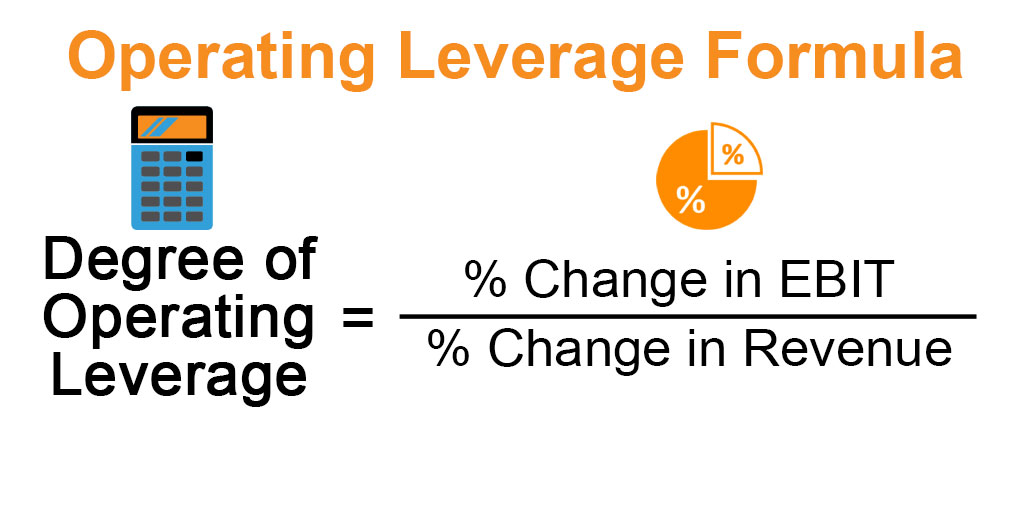

Degree of Operating Leverage DOL Calculator. If the stock goes down 1. Of course margins differ depending on the benchmark and the stock.

Stock brokers can accept securities as margin from clients only by way of pledge in the depository system wef. 10 lakh you must deposit Rs. Firstly determine the cost of goods sold incurred by the company during the periodIt is the sum of all the direct and indirect costs that can be apportioned to the job order or product.

Leverage can work against you as well as for you. The below calculator will calculate the fair market price the Greeks and the probability of closing in-the-money ITM for an option contract using your choice of either the Black-Scholes or Binomial Tree pricing modelThe binomial model is most appropriate to use if the buyer can exercise the option contract before expiration ie American style options. You may insert your preferred askbid prices or let the calculator use the latest prices set by the market.

Stock quotes reflect trades reported through Nasdaq only. Intraday data delayed at least 15 minutes or per exchange. Earnings Before Interest Taxes Depreciation and Amortization EBITDA Calculator.

Trading FX and CFDs on margin carries a high level of risk and may not be suitable for all investorsCMS Prime offers trading on margin. Just look at the market this month and youll know what I meanor think back to early. The changing regulations by the Securities and Exchange Board of India SEBI that limit the amount of leverage a trader can get from a broker helped the Indian stock markets from a severe crash.

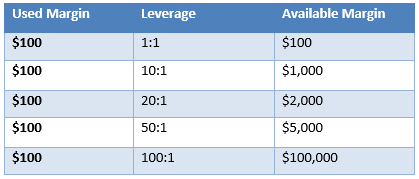

Leverage can be used to help finance anything from a home purchase to stock market speculation. As you can see leverage has an inverse relationship to margin. The formula for a stock turnover ratio can be derived by using the following steps.

For example your leverage is 11000. For Indices the point value will be based in the currency of the country that hosts that stock index. Thats cold comfort when your portfolio has lost 20 or even 30 of its value in a stock market crash.

Present Value and Future Value. Hit Calculate After you click Calculate you will see the results below. This multiple to trade is referred to as leverage.

Before you decide to invest or trade in capital markets you should carefully consider your investment objectives level of experience. If the market value is 70 youll lose 2000.

The Relationship Between Margin And Leverage Babypips Com

The Relationship Between Margin And Leverage Babypips Com

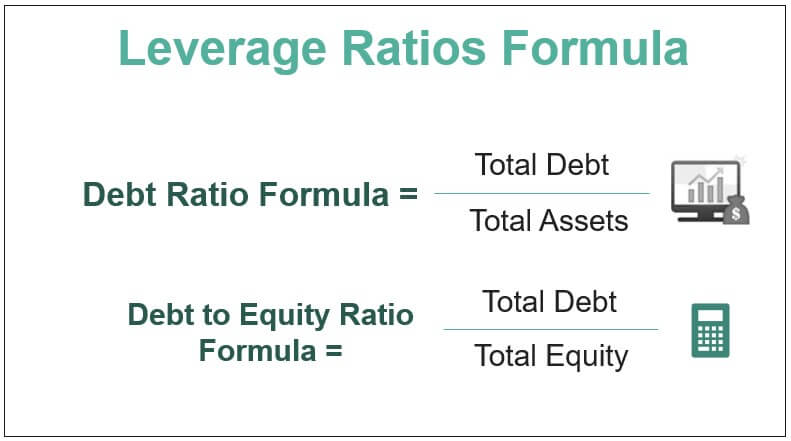

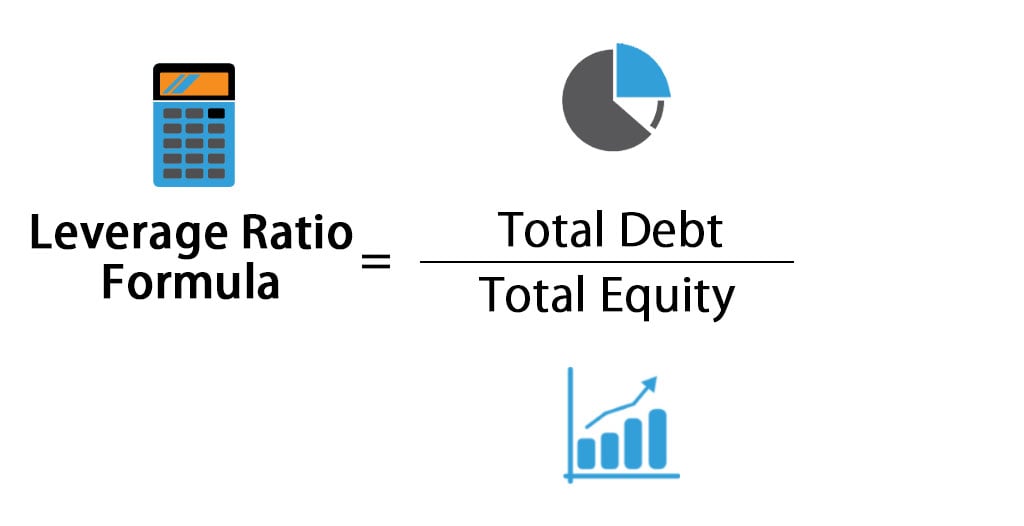

Leverage Ratio Formula And Calculator Excel Template

Pin On Online Trading Platforms Updates

Forex Kenya Forex Somali Forex For Beginners Stuart Forex Calculator Pip Forex Beginners Cours Trading Charts Technical Trading Forex Trading Quotes

Operating Leverage Formula Calculator Example With Excel Template

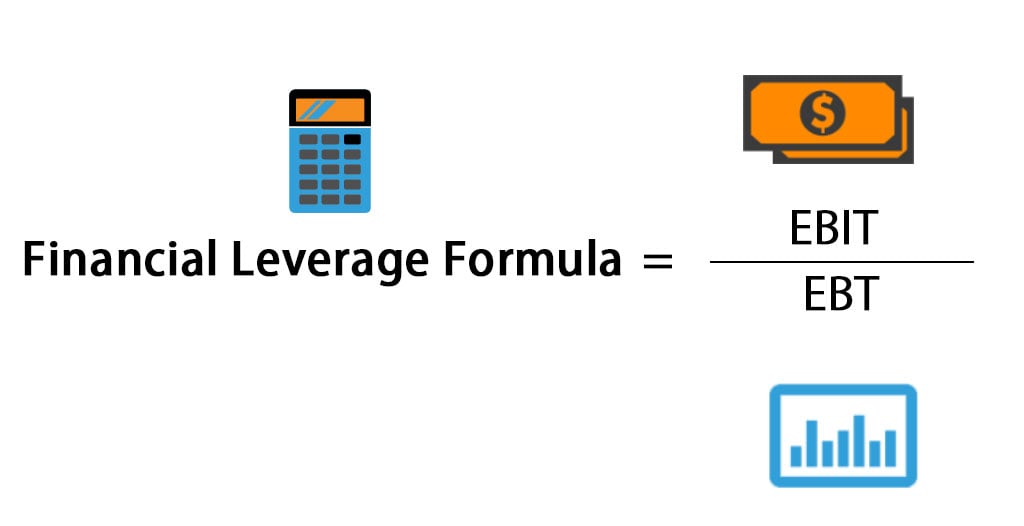

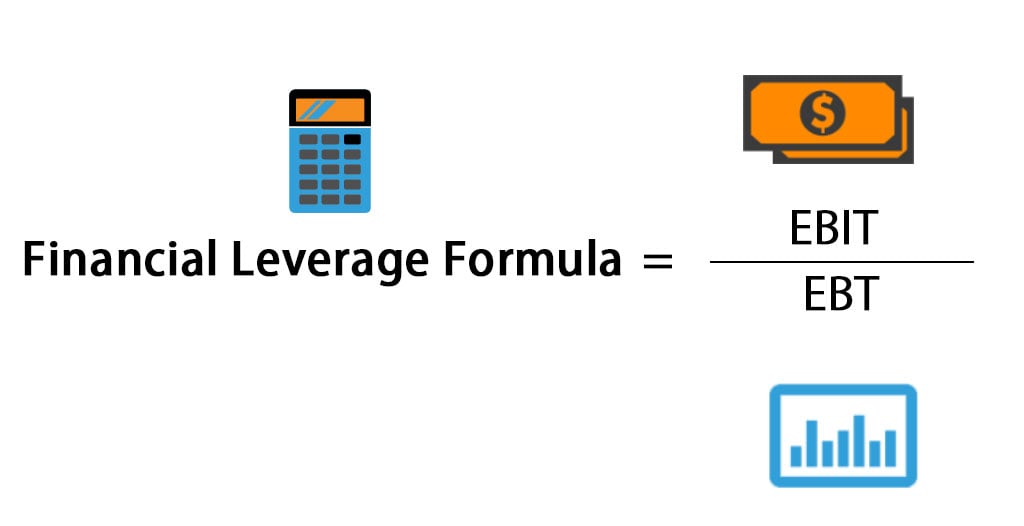

Financial Leverage Formula Calculator Excel Template

Leveraged Buyout Model Calculator Plan Projections Leveraged Buyout Financial Analysis How To Plan

Leverage Ratios Formula Step By Step Calculation With Examples

Bet On These 33 Stocks Having Low Financial Leverage Strong Competitive Positioning Moneycontrol Com Financial Investment Tips Business Leader

Leverage Calculator Myfxbook

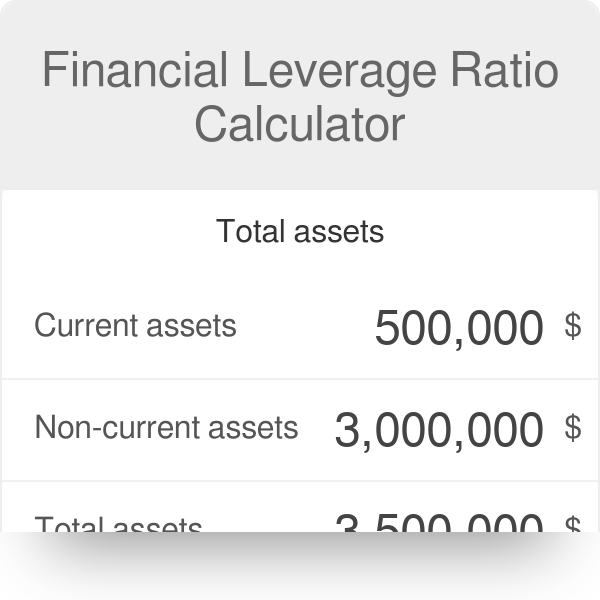

Financial Leverage Ratio Calculator Formula

Leverage Ratio Formula Calculator Excel Template

Learn The Use Of Forex Leverage And Margin In Forex Trading What Is Forex Leverage And What Is Forex Margin How To Calculate Forex Forex Trading Forextrading

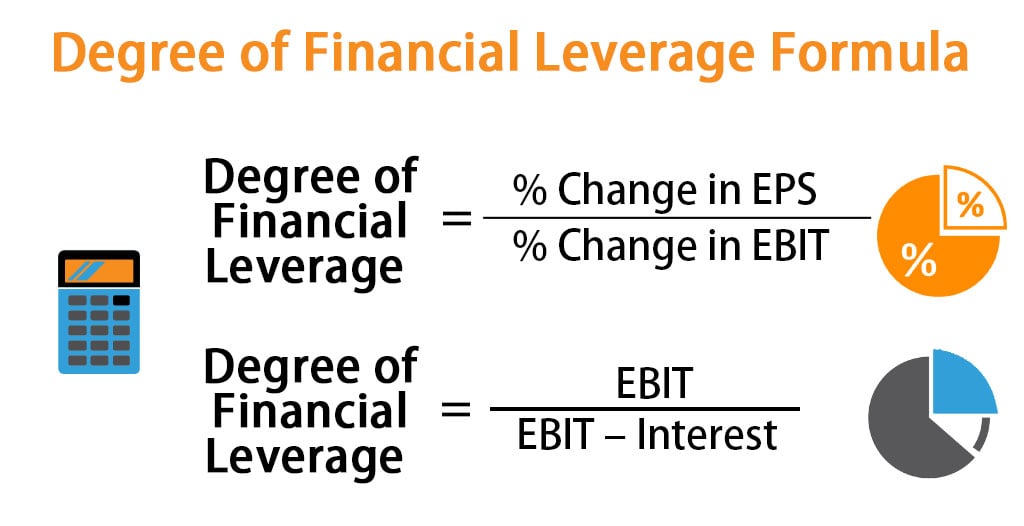

Degree Of Financial Leverage Formula Calculator Excel Template

Operating Leverage Formula And Calculator Excel Template

Investment In 2022 Tax Deducted At Source Deposit Income Tax